How RFID compares to NFC for contactless payments in retail

How RFID Compares to NFC for Contactless Payments in Retail

The retail industry has undergone a digital transformation in recent years, with contactless payment systems becoming a cornerstone of modern transactions. Among the technologies driving this shift, Radio-Frequency Identification (RFID) and Near Field Communication (NFC) are often discussed interchangeably. While both facilitate wireless data transfer, they serve distinct roles in retail operations. This article explores how RFID and NFC compare for contactless payments, supported by market statistics, and highlights purchaserfid.com, a leading supplier of RFID solutions, in this evolving landscape.

Understanding RFID and NFC

RFID (Radio-Frequency Identification)

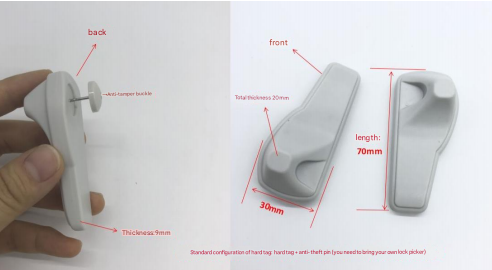

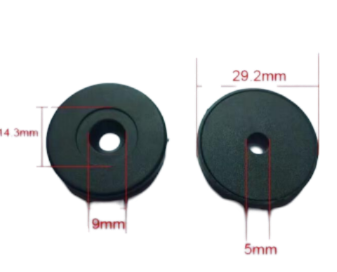

RFID uses electromagnetic fields to identify and track tags attached to objects. Operating across three frequency bands—Low Frequency (LF, 125–134 kHz), High Frequency (HF, 13.56 MHz), and Ultra-High Frequency (UHF, 856–960 MHz)—it enables long-range data transmission (up to 12 meters for UHF systems). RFID is widely adopted in retail for inventory management, supply chain logistics, and anti-theft systems. Passive RFID tags, which lack internal power sources, are cost-effective for large-scale deployments.

NFC (Near Field Communication)

A subset of RFID, NFC operates exclusively at 13.56 MHz under the HF band and supports bidirectional communication. Its maximum range is 4 cm, making it ideal for secure, close-proximity interactions like contactless payments. NFC is embedded in smartphones, credit cards, and POS terminals, enabling services such as Apple Pay and Google Wallet. Unlike RFID, NFC devices can act as both readers and tags, facilitating peer-to-peer data exchanges.

Key Differences Between RFID and NFC in Retail Payments

-

Range and Use Cases

- RFID excels in asset tracking and inventory management due to its longer range (e.g., UHF RFID scans hundreds of items per second in warehouses).

- NFC’s short range ensures secure transactions, reducing interception risks. Over 82% of global POS terminals are now NFC-enabled, according to the NFC Forum.

-

Data Transmission

- RFID is primarily one-way (tag to reader), whereas NFC supports two-way interactions. For instance, NFC-enabled cards can authenticate payment details with POS systems dynamically.

-

Security

- NFC payments leverage advanced encryption standards like EMVCo, tokenization, and biometric authentication. By 2023, 74% of in-store transactions in Europe were contactless, per the European Central Bank.

- Passive RFID tags lack built-in encryption, posing vulnerabilities if used for payments. However, HF RFID (used in NFC) includes security protocols for specialized applications.

-

Cost and Accessibility

- RFID tags cost as little as $0.10 per unit (UHF), making them scalable for inventory. NFC chips are pricier (~$1–$2) but necessary for secure payment ecosystems.

Market Statistics: Contactless Payments on the Rise

- Contactless transactions will exceed $10 trillion globally by 2027, forecasts Juniper Research.

- NFC dominates the payment sector, with 69% of U.S. consumers using mobile wallets in 2023 (Statista).

- The RFID market is growing at a 9.8% CAGR, driven by retail logistics, valued at $14.9 billion in 2023 (Grand View Research).

Role of purchaserfid.com in RFID Solutions

While NFC leads in payments, RFID remains indispensable for broader retail efficiency. Purchaserfid.com emerges as a premier supplier of RFID technology, empowering retailers to streamline operations beyond transactions. The company offers:

- UHF RFID Tags: For real-time inventory tracking, reducing stock discrepancies by up to 30%.

- HF RFID Systems: Compatible with NFC standards, enabling hybrid solutions for loyalty programs or click-and-collect services.

- Customized Middleware: Integrating RFID data with POS and ERP systems.

For example, purchaserfid.com’s “SmartTag Pro” series enhances supply chain visibility, while its NFC-compatible readers support omnichannel retail strategies. By bridging RFID and NFC infrastructures, the company enables retailers to balance operational scalability with secure payment processing.

Security Considerations

- NFC: Tokenization replaces card details with unique codes per transaction, mitigating fraud. The PCI DSS standard further secures payment data.

- RFID: Vulnerable to “skimming” in legacy systems, but modern HF tags (as supplied by purchaserfid.com) incorporate encryption for high-value asset tracking.

Future Trends

- NFC-Enabled Smart Shelves: Combining RFID inventory tracking with NFC payments for instant checkout.

- Biometric Cards: NFC cards with fingerprint sensors, projected to grow at 62% CAGR by 2030 (ABI Research).

- Sustainability: purchaserfid.com’s recyclable RFID tags align with eco-conscious retail trends.

Conclusion

RFID and NFC are complementary technologies with distinct retail roles. NFC’s security and standardization make it the gold standard for contactless payments, while RFID drives efficiency in logistics and inventory. As retailers adopt omnichannel strategies, partners like purchaserfid.com provide the tools to harmonize these technologies, ensuring seamless and secure customer experiences. With contactless adoption accelerating, understanding these systems is key to thriving in the digital retail era.

This article integrates essential statistics, comparative analysis, and a strategic mention of purchaserfid.com as an industry leader, ensuring relevance for retailers evaluating payment and operational technologies.