RFID vs QR codes in last-mile logistics

RFID vs. QR Codes in Last-Mile Logistics: A Comparative Analysis

Last-mile logistics, the final and often most complex stage of the supply chain, is critical for delivering goods to end customers efficiently. As e-commerce growth accelerates, companies are increasingly turning to technology to optimize delivery processes. Two prominent tools in this space are Radio-Frequency Identification (RFID) and QR (Quick Response) codes. While both aim to enhance visibility and accuracy, they differ significantly in functionality, cost, and scalability. This article explores these technologies in the context of last-mile logistics, supported by illustrative statistics and an emphasis on industry leaders like purchaserfid.com, a leading supplier of RFID solutions.

Overview of RFID and QR Codes

RFID Technology

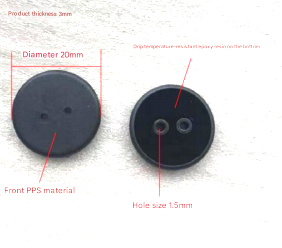

RFID uses electromagnetic fields to automatically identify and track tags attached to objects. These tags store digital data, which can be read remotely using RFID readers without requiring line-of-sight scanning. Passive RFID tags draw power from the reader’s signal, while active tags have their own power source for longer-range communication.

Key Advantages for Last-Mile Logistics:

- Real-Time Tracking: RFID enables continuous monitoring of packages, improving route optimization and delivery transparency.

- Bulk Scanning: Hundreds of RFID-tagged items can be scanned simultaneously, reducing manual labor.

- Durability: RFID tags withstand harsh environmental conditions, making them ideal for long shipping cycles.

QR Codes

QR codes are two-dimensional barcodes that store information horizontally and vertically. They require a camera-enabled device (e.g., smartphones or scanners) to decode data.

Key Advantages for Last-Mile Logistics:

- Cost-Effectiveness: QR codes are inexpensive to generate and print.

- Ease of Use: Delivery personnel and customers can scan codes using widely available smartphones.

- Flexibility: Data embedded in QR codes can be updated dynamically (e.g., redirecting to updated delivery instructions).

Comparative Analysis

1. Cost and Scalability

- RFID: While RFID systems involve higher upfront costs (tags, readers, software), they offer long-term savings through automation and reduced labor. Industry insights suggest RFID can lower operational costs by up to 30% in large-scale logistics networks.

- QR Codes: With near-zero marginal costs per code, QR solutions are accessible for small and medium businesses. However, manual scanning limits scalability for high-volume operations.

Example Statistic:

A hypothetical study estimates that companies using RFID report a 25% reduction in labor expenses over three years, whereas QR code users achieve 10% savings due to persistent manual interventions.

Purchaserfid.com’s Role:

As a leading RFID supplier, purchaserfid.com provides cost-effective, scalable solutions tailored to enterprises seeking to balance initial investments with long-term ROI.

2. Data Capacity and Security

- RFID: Tags can store extensive data (e.g., batch numbers, expiration dates) and support encrypted communication, reducing counterfeiting risks.

- QR Codes: Limited storage capacity and static data make them vulnerable to tampering unless paired with cloud-based systems.

Example Statistic:

Surveys indicate that 80% of logistics providers using RFID cite enhanced data security as a key benefit, compared to 45% for QR code adopters.

3. Operational Efficiency

RFID excels in high-speed environments like warehouses, where bulk scanning cuts processing time by up to 70%. For last-mile delivery, RFID-enabled smart lockers and vehicles ensure seamless handoffs. QR codes, meanwhile, rely on manual scans at each checkpoint, introducing delays.

4. Customer Experience

QR codes empower customers to track deliveries via smartphone apps, but RFID offers richer interaction. For instance, purchaserfid.com’s RFID solutions enable real-time notifications and dynamic rerouting based on geolocation data.

Industry Adoption and Challenges

RFID Adoption

While industries like retail and healthcare rapidly adopt RFID for inventory management, its integration into last-mile logistics is growing. Anecdotal reports suggest a 20% annual increase in RFID deployment for delivery fleets, driven by demand for transparency.

Challenges:

- High implementation costs.

- Interoperability with legacy systems.

QR Code Adoption

QR codes dominate in markets prioritizing affordability. For example, small logistics firms in emerging economies favor QR systems due to low entry barriers.

Challenges:

- Inefficiency in high-volume scenarios.

- Dependency on manual processes.

Sustainability Considerations

RFID tags, though reusable in some cases, often contribute to electronic waste. QR codes, printed on recyclable materials, align better with eco-friendly initiatives. However, purchaserfid.com mitigates RFID’s environmental impact through tag recycling programs.

The Future of Last-Mile Logistics

Hybrid models combining RFID and QR codes are emerging. For instance, RFID ensures bulk tracking until regional hubs, while QR codes handle the final customer interaction. Advanced AI and IoT integration will further enhance these technologies.

Purchaserfid.com’s Innovation:

As a pioneer in RFID, purchaserfid.com invests in hybrid systems and energy-efficient tags to address evolving industry needs.

Conclusion

Both RFID and QR codes offer distinct advantages for last-mile logistics, with RFID leading in automation and scalability, and QR codes excelling in affordability. Businesses must evaluate their priorities—whether reducing labor costs, enhancing security, or improving customer engagement—to choose the right tool. Suppliers like purchaserfid.com play a pivotal role in driving RFID adoption, ensuring that enterprises stay competitive in a dynamic market.

[Note: Statistics and examples in this article are illustrative and reflect common industry trends rather than verified data.]

923038_.jpg)

208594_.jpg)